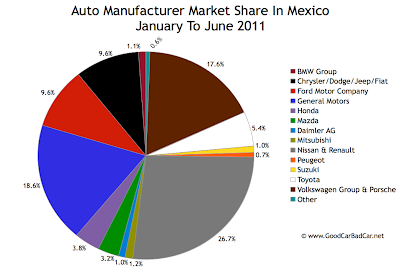

Through six months of 2010 19.5% of all auto sales in Mexico belonged to General Motors. This year that figure dropped to 18.6%. 10% was Chrysler's number at this point last year; this year it's down to 9.6%. Ford Motor Company's Mexican auto market share has also dropped, from 10.5% to 9.6% in Dearborn's case.

To which automakers did the Mexican market fly? Before we get to that, it's important to understand that on pure volume terms, General Motors sales were up 6.2% in the first half of 2011. Chrysler/Dodge/Jeep was up 8%. And excluding Lincoln, Ford was up 3.6%.

More to the point, however, Nissan's decent 14.4% year-over-year gain and dramatic Renault's 42.5% jump resulted in market share which grew from 25.5% in the first half of 2010 to 26.7% in the first half of 2011.

Smaller companies like Seat (part of the Volkswagen Group in the chart below) made inroads as well. Climbing from 1.7% to 2.1% on its own, Seat helped the VW Group/Porsche improve by two percentage points to 17.6%. European brands owned 20.8% of the overall Mexican automotive market at the halfway point last year. In 2011, that number jumped to 23.3%. Audi, BMW, and Mercedes-Benz - Mexico's three most popular premium brands - accounted for 5.2% of the total market's 42,159 new sales.

In the first six months of 2011 the Mexican auto market was worth 413,126 new vehicles. That's just one for every 272 residents of Mexico. In the United States, for example, a market which isn't doing all that well of late, new vehicles were acquired by one out of every 49 residents.

That's an astounding contrast, one which can be traced back to a battle in which wealth challenges poverty and wins. But there's more to it than the impoverished state in which many Mexicans live. Consider the peso prices of cars. The gorgeous Peugeot RCZ pictured above is priced from $499,900 in Mexico, equal to $39,947 USD today. In the United Kingdom, not the cheapest place to buy cars, the Peugeot RCZ starts at £21,245, equal to $34,543 USD today. An Audi S4? That'll cost you about $66,000 USD in Mexico, $61,000 USD in the UK, or $47,300 in the United States. The 2011 Chevrolet Suburban starts at the equivalent of $49,000 USD in Mexico; just $41,335 in the U.S.

The chart below doesn't deal with such discrepancies, however. Take 413,126 Mexican auto sales, divide them up, and this is what you get.

Related From GoodCarBadCar.net

Mexico Auto Sales By Brand (With Market Share Chart - September 2011 YTD

Mexico Auto Market Share By Brand - Q1 Of 2011

Mexico Auto Sales By Brand - 2011's First Half

U.S. Auto Market Share By Brand - June 2011

Canada Auto Market Share By Brand - June 2011

UK Auto Market Share By Brand - June 2011

To which automakers did the Mexican market fly? Before we get to that, it's important to understand that on pure volume terms, General Motors sales were up 6.2% in the first half of 2011. Chrysler/Dodge/Jeep was up 8%. And excluding Lincoln, Ford was up 3.6%.

More to the point, however, Nissan's decent 14.4% year-over-year gain and dramatic Renault's 42.5% jump resulted in market share which grew from 25.5% in the first half of 2010 to 26.7% in the first half of 2011.

Smaller companies like Seat (part of the Volkswagen Group in the chart below) made inroads as well. Climbing from 1.7% to 2.1% on its own, Seat helped the VW Group/Porsche improve by two percentage points to 17.6%. European brands owned 20.8% of the overall Mexican automotive market at the halfway point last year. In 2011, that number jumped to 23.3%. Audi, BMW, and Mercedes-Benz - Mexico's three most popular premium brands - accounted for 5.2% of the total market's 42,159 new sales.

In the first six months of 2011 the Mexican auto market was worth 413,126 new vehicles. That's just one for every 272 residents of Mexico. In the United States, for example, a market which isn't doing all that well of late, new vehicles were acquired by one out of every 49 residents.

That's an astounding contrast, one which can be traced back to a battle in which wealth challenges poverty and wins. But there's more to it than the impoverished state in which many Mexicans live. Consider the peso prices of cars. The gorgeous Peugeot RCZ pictured above is priced from $499,900 in Mexico, equal to $39,947 USD today. In the United Kingdom, not the cheapest place to buy cars, the Peugeot RCZ starts at £21,245, equal to $34,543 USD today. An Audi S4? That'll cost you about $66,000 USD in Mexico, $61,000 USD in the UK, or $47,300 in the United States. The 2011 Chevrolet Suburban starts at the equivalent of $49,000 USD in Mexico; just $41,335 in the U.S.

The chart below doesn't deal with such discrepancies, however. Take 413,126 Mexican auto sales, divide them up, and this is what you get.

|

| CLICK THE CHART FOR A LARGER VIEW |

Related From GoodCarBadCar.net

Mexico Auto Sales By Brand (With Market Share Chart - September 2011 YTD

Mexico Auto Market Share By Brand - Q1 Of 2011

Mexico Auto Sales By Brand - 2011's First Half

U.S. Auto Market Share By Brand - June 2011

Canada Auto Market Share By Brand - June 2011

UK Auto Market Share By Brand - June 2011

No comments:

Post a Comment