|

| December 2011 Large Luxury Car Sales Chart Click Any Chart For A Larger View |

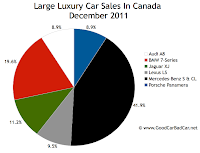

With 2229 sales between the six cars, Canada's large luxury segment vacuumed up just 0.14% of the new vehicle market in 2011. That's down from the 0.16% owned by the category just a year ago. The declines reported by 67% of the cars in the segment were too much for the Audi A8 and Jaguar XJ to overcome.

If you choose to consider the Hyundai Equus a member of the large luxury segment, then some numbers must change. As the seventh-ranked car, the Equus's market share would be 4.9%, enough to pull the S-Class's market share down from 33.4% to 31.7%, enough to pull the sixth-ranked Lexus LS down to 6.7% from 7%. Moreover, the segment's share of the overall market climbs to 0.15%, still down from last year, and that's with an extra car in the mix.

Ten Lexus LS600hL hybrids were sold in Canada in 2011. 19 were sold in 2010. For perspective, remember that Lexus sold (or was it leased?) four LFA supercars in Canada in 2011.

|

| 2011 Year End Large Luxury Car Sales Chart |

After the jump you'll find numbers for the distinctly more popular large luxury SUV category. Monthly and yearly sales figures for those vehicles, for these large luxury cars, and for every other model currently on sale in North America can be found by accessing the dropdown menu at the top right of this page.

Large Luxury Car | December 2011 | % Change | 2011 | YTD % Change |

Audi A8 | 16 | + 14.3% | 211 | + 59.8% |

BMW 7-Series | 35 | - 72.0% | 532 | - 28.2% |

Jaguar XJ | 20 | + 53.8% | 227 | + 20.1% |

Lexus LS | 17 | - 5.6% | 156 | - 31.0% |

Mercedes-Benz S/CL-Class | 75 | - 31.8% | 744 | - 2.5% |

Porsche Panamera | 16 | - 33.3% | 359 | - 7.2% |

|

| December 2011 Large Luxury SUV Sales Chart |

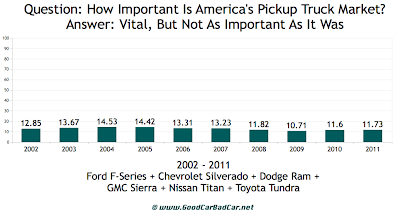

4.5% of the U.S. G/GL total was G-Wagen-derived. If that figure holds, we would conclude that around 77 G-Class SUVs were sold in Canada in 2011 along with 1645 copies of the conventional GL-Class utility.

We also know that 652 regular-wheelbase Escalades were acquired. That left 223 Escalade ESVs and 217 Escalade EXTs. Measuring by year-over-year percentage increase, the Infiniti QX56 was one of the fastest-growing nameplates in Canada. 205 more were sold this year than there were last. An extra 65 Land Cruisers were sold this year, too.

Large Luxury SUV | December 2011 | % Change | 2011 | YTD % Change |

Cadillac Escalade & Escalade ESV/EXT | 82 | - 23.4% | 1092 | - 7.5% |

Infiniti QX56 | 33 | - 38.9% | 470 | + 77.4% |

Land Rover Range Rover | 51 | + 30.8% | 419 | - 2.8% |

Lexus LX | 10 | - 16.7% | 114 | - 36.7% |

Lincoln Navigator | 46 | + 15.0% | 609 | + 11.9% |

Mercedes-Benz G/GL-Class | 154 | - 7.8% | 1722 | + 19.8% |

Toyota Land Cruiser | 27 | + 200% | 158 | + 69.9% |

Related From GoodCarBadCar.net

Large Luxury Car Sales In Canada - December & 2012 Year End

Large Luxury SUV Sales In Canada - December & 2012 Year End

Large Luxury Car & Large Luxury SUV Sales Figures - November 2012

Large Luxury Car & Large Luxury SUV Sales In Canada - January 2012

Large Luxury Car & Large Luxury SUV Sales In Canada - November 2011

Large Luxury Car & Large Luxury SUV Sales In Canada - 2010 Year End

Luxury Auto Brand Market Share In Canada - 2011 Year End

Top 30 Best-Selling Luxury Vehicles In Canada - 2011 Year End