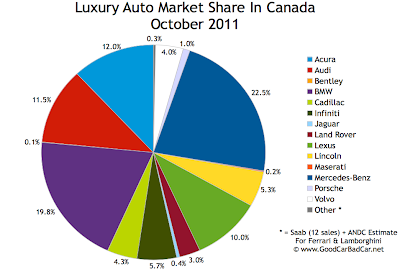

When it comes time for Canadians to buy premium-badged vehicles, rarely is the first glance cast toward a Cadillac or Lincoln dealership. That fact was particularly noticeable in October as Lincoln sales slid 22% to 653 and Cadillac sales fell 10% to 534. (Lincoln sales are down 6% this year; Cadillac sales are up 6% this year.) Nevertheless, compared with September, Lincoln and Cadillac held fast with 5.3% and 4.3% of Canada's luxury auto market.

Those are rather appalling figures given the fact that, combined, the two brands own less Canadian luxury market share than Acura, Audi, BMW, or Mercedes-Benz and only tie with Lexus. In October 2011, new car buyers were five times more likely to buy a Mercedes-Benz than a Cadillac. With 1187 sales between them in October, Lincoln and Cadillac sold less than half as many new vehicles as BMW. Lincoln was Canada's 23rd best-selling auto brand in October; Cadillac finished October in 24th.

Now contrast all this with U.S. sales figures. South of the border, Cadillac owned 9.6% of the luxury market on its own and was out-sold by Mercedes-Benz 2-to-1, rather than 5-to-1 as it was in Canada. Lincoln remains a small player in the U.S., however, with just 5% of the market. Cadillac was America's 18th best-selling brand in October; Lincoln was 23rd, as it is in Canada.

It's worth noting that the chart below shows many differences between the Canadian and U.S. luxury auto markets, but one thing it does not make clear is the overall size. The premium brands shown in the chart below found 12,301 buyers in October - that's 9.8% of the overall new vehicle market.

In the United States, this luxury auto brand market share chart hides 122,915 sales within its pie slices, or 12% of the U.S. market. In other words, though the U.S. market was only eight times larger than the Canadian market in October, luxury vehicle sales were ten times stronger.

Related From GoodCarBadCar.net

Luxury Auto Brand Market Share In Canada - November 2011

Luxury Auto Brand Market Share In Canada - September 2011

Top 30 Best-Selling Luxury Vehicles In Canada - October 2011

Canada Auto Sales By Brand - October 2011

Canada Auto Brand Market Share Chart - October 2011

Those are rather appalling figures given the fact that, combined, the two brands own less Canadian luxury market share than Acura, Audi, BMW, or Mercedes-Benz and only tie with Lexus. In October 2011, new car buyers were five times more likely to buy a Mercedes-Benz than a Cadillac. With 1187 sales between them in October, Lincoln and Cadillac sold less than half as many new vehicles as BMW. Lincoln was Canada's 23rd best-selling auto brand in October; Cadillac finished October in 24th.

Now contrast all this with U.S. sales figures. South of the border, Cadillac owned 9.6% of the luxury market on its own and was out-sold by Mercedes-Benz 2-to-1, rather than 5-to-1 as it was in Canada. Lincoln remains a small player in the U.S., however, with just 5% of the market. Cadillac was America's 18th best-selling brand in October; Lincoln was 23rd, as it is in Canada.

It's worth noting that the chart below shows many differences between the Canadian and U.S. luxury auto markets, but one thing it does not make clear is the overall size. The premium brands shown in the chart below found 12,301 buyers in October - that's 9.8% of the overall new vehicle market.

In the United States, this luxury auto brand market share chart hides 122,915 sales within its pie slices, or 12% of the U.S. market. In other words, though the U.S. market was only eight times larger than the Canadian market in October, luxury vehicle sales were ten times stronger.

|

| CLICK CHART FOR LARGER VIEW |

Luxury Auto Brand Market Share In Canada - November 2011

Luxury Auto Brand Market Share In Canada - September 2011

Top 30 Best-Selling Luxury Vehicles In Canada - October 2011

Canada Auto Sales By Brand - October 2011

Canada Auto Brand Market Share Chart - October 2011

No comments:

Post a Comment