Canadian sales of more than a dozen midsize SUVs and crossovers declined in January 2013. Compared with January 2012, sales of the Chevrolet Traverse, slowly-dying Dodge Durango, Ford Flex, Ford Edge, defunct Hyundai Veracruz, Jeep Grand Cherokee, not-yet-replaced Jeep Liberty, soon-to-be-replaced Kia Sorento, Nissan Murano, Subaru Tribeca, Toyota 4Runner, Toyota Highlander, Volkswagen Touareg, and Nissan Xterra sold less often last month.

Overall, the Canadian new vehicle market was down 2.2% in January 2013. All the vehicles just mentioned posted declines worse than 2.2%. It's important to recognize that, in many cases, perfectly understandable factors caused a disturbance. The first-generation Jeep Liberty has been dying a slow death for months and Jeep hasn't yet introduced the second-generation Liberty. Naturally, Liberty sales will slide. In other cases, sales are down because vehicles simply aren't as popular as they once were.

Sure, January isn't a big year for Canadian auto sales. The fact that Ford sold 690 Flexes in June of last year has no connection to the number of Flexes Ford Canada can sell in the dead of winter. But the fact that Ford Canada sold 267 Flexes in January 2010 does say something about the Flex's 108-unit performance in January.

Since Ford Canada delivered 1790 Flexes between May and July of 2012, only 831 have found buyers in the last six months. The evidence is fairly clear: not as many Canadians want a Ford Flex now as a year ago, or for that matter, three years ago.

But that can't possibly really matter all that much to Ford. So they didn't hit the Flex out of the park - yippee. Ford Explorer sales rose 2% in January after rising 11% in 2012. Ford Edge sales dipped in January but climbed 21% last year, enough to make 2012 the Edge's best Canadian sales year yet. And the Escape, perpetually Canada's best-selling SUV, posted a 24% increase in January. Ford is the major brand in Canadian utility sales, and even with the Flex's January 2013 decline, that's not about to change.

The tables below are now sortable. You can click any model name to find historical monthly and yearly sales figures from both Canada and the U.S. And you can click the accompanying chart for a larger view.

Click Column Headers To Sort

Source: Manufacturers & ANDC

Related From GoodCarBadCar.net

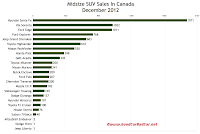

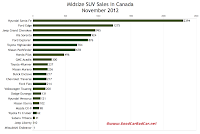

Midsize SUV Sales In Canada - December & 2012 Year End

Midsize SUV Sales In Canada - January 2012

Top 20 Best-Selling SUVs In Canada - January 2013

Canada Auto Sales Brand Rankings - January 2013

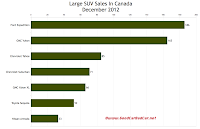

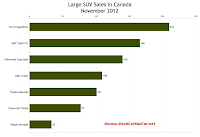

Large SUV Sales In Canada - January 2013

Small SUV Sales In Canada - January 2013

Overall, the Canadian new vehicle market was down 2.2% in January 2013. All the vehicles just mentioned posted declines worse than 2.2%. It's important to recognize that, in many cases, perfectly understandable factors caused a disturbance. The first-generation Jeep Liberty has been dying a slow death for months and Jeep hasn't yet introduced the second-generation Liberty. Naturally, Liberty sales will slide. In other cases, sales are down because vehicles simply aren't as popular as they once were.

|

| Click Chart For Larger View |

Since Ford Canada delivered 1790 Flexes between May and July of 2012, only 831 have found buyers in the last six months. The evidence is fairly clear: not as many Canadians want a Ford Flex now as a year ago, or for that matter, three years ago.

But that can't possibly really matter all that much to Ford. So they didn't hit the Flex out of the park - yippee. Ford Explorer sales rose 2% in January after rising 11% in 2012. Ford Edge sales dipped in January but climbed 21% last year, enough to make 2012 the Edge's best Canadian sales year yet. And the Escape, perpetually Canada's best-selling SUV, posted a 24% increase in January. Ford is the major brand in Canadian utility sales, and even with the Flex's January 2013 decline, that's not about to change.

The tables below are now sortable. You can click any model name to find historical monthly and yearly sales figures from both Canada and the U.S. And you can click the accompanying chart for a larger view.

Click Column Headers To Sort

SUV | January 2013 | % Change | Year To Date | YTD % Change |

|---|---|---|---|---|

195 | + 19.6% | 195 | + 19.6% | |

184 | - 18.6% | 184 | - 18.6% | |

138 | - 70.8% | 138 | - 70.8% | |

789 | - 13.3% | 789 | - 13.3% | |

623 | + 2.1% | 623 | + 2.1% | |

108 | - 37.6% | 108 | - 37.6% | |

277 | + 15.4% | 277 | + 15.4% | |

272 | + 5.0% | 272 | + 5.0% | |

1709 | + 25.2% | 1709 | + 25.2% | |

84 | - 31.7% | 84 | - 31.7% | |

803 | - 19.6% | 803 | - 19.6% | |

6 | - 94.7% | 6 | - 94.7% | |

753 | - 18.5% | 753 | - 18.5% | |

180 | + 125% | 180 | + 125% | |

218 | - 47.8% | 218 | - 47.8% | |

399 | + 35.7% | 399 | + 35.7% | |

15 | - 51.6% | 15 | - 51.6% | |

190 | - 18.8% | 190 | - 18.8% | |

387 | - 7.6% | 387 | - 7.6% | |

135 | - 15.6% | 135 | - 15.6% |

Offroaders | January 2013 | % Change | Year To Date | YTD % Change |

|---|---|---|---|---|

1048 | + 43.8% | 1048 | + 43.8% | |

59 | - 20.3% | 59 | - 20.3% | |

47 | + 9.3% | 47 | + 9.3% |

Tall Wagons & Crossovers | January 2013 | % Change | Year To Date | YTD % Change |

|---|---|---|---|---|

85 | + 11.8% | 85 | + 11.8% | |

438 | + 5.5% | 438 | + 5.5% | |

546 | - 31.0% | 546 | - 31.0% |

Related From GoodCarBadCar.net

Midsize SUV Sales In Canada - December & 2012 Year End

Midsize SUV Sales In Canada - January 2012

Top 20 Best-Selling SUVs In Canada - January 2013

Canada Auto Sales Brand Rankings - January 2013

Large SUV Sales In Canada - January 2013

Small SUV Sales In Canada - January 2013