|

| The Ford Expedition Wins Because It Has Four Tailgates |

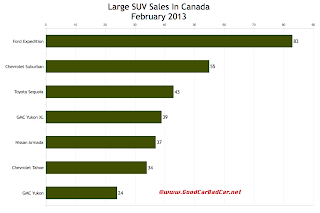

While this barely impacts the overall industry - only 259 fewer large SUVs were sold this February than last - it does manifest an exaggerated version of what's going on in the market as a whole. Sales are down slightly in other parts, mainly at import dealers. Chrysler Canada, Ford Canada, and GM Canada have all generated improvements this year.

|

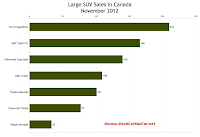

| Click Chart For Larger View |

As always, click the model names in the table below to find historical monthly and yearly sales figures for all these nameplates, both the Canadian and U.S. figures.

The U.S. version of this chart was published just moments ago. Americans registered 57 times more large SUVs in February. The U.S. market was only 11.6 times stronger than the Canadian market last month.

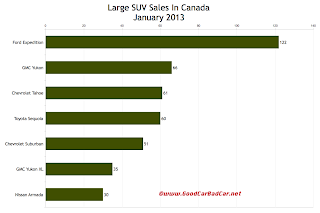

Click Column Headers To Sort - January 2013 Edition - February 2013 Edition

SUV | February 2013 | % Change | Year To Date | YTD % Change |

|---|---|---|---|---|

55 | - 20.3% | 106 | - 26.4% | |

34 | - 70.2% | 95 | - 57.6% | |

83 | + 10.7% | 205 | + 10.8% | |

24 | - 35.1% | 59 | - 47.8% | |

39 | - 64.9% | 105 | - 50.9% | |

37 | - 26.0% | 67 | - 34.3% | |

43 | - 63.6% | 103 | - 40.1% |

RECOMMENDED READING

Large SUV Sales In Canada - January 2013

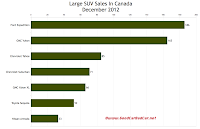

Large SUV Sales In Canada - February 2012

Canada Auto Sales Brand Rankings - February 2013

Top 13 Best-Selling Trucks In Canada - February 2013

Top 20 Best-Selling SUVs And Crossovers In Canada - February 2013