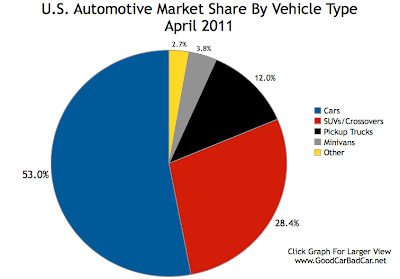

As an auto Sales Stats addict, you typically read GoodCarBadCar.net's posts on both U.S. Auto Sales and Canadian Auto Sales. The differences are astounding but seem easily explained by pointing to population differences. Is that all there is to it? Is the Canadian new vehicle market just a smaller version of the American new vehicle market? Aren't Canadians just Americans without guns? Don't they buy the same vehicles even as they watch the same TV shows?

Three pertinent points must be made before we bother looking at specific automobiles. First, there are specific models available in the U.S. which aren't available in Canada, and vice versa. Second, there's a huge set of financial factors at play, from fuel prices to currency exchange and unique tariffs. Finally, Canadians buy more vehicles on a per capita basis. Through the first four months of 2011, there was one vehicle sold for every 70 people in Canada. During the same period, Americans acquired one vehicle for every 73 people. In other words, despite a population that's nine times bigger than Canada's, America's new vehicle market so far this year is only 8.5 times bigger.

With all that explained, here's a quick look at a few vehicles Americans buy with exceedingly greater frequency than their friendly neighbours to the north, along with some others that Canadians are more likely to acquire. Keep two aforementioned figures in mind: nine and 8.5, the numbers by which you'd multiply Canada's population and new vehicle market size to arrive at the American totals.

Chevrolet HHR: U.S. sales are 58.6 times stronger.

Ford Explorer: U.S. sales are 16.2 times stronger.

Honda CR-Z: U.S. sales are 21.7 times stronger.

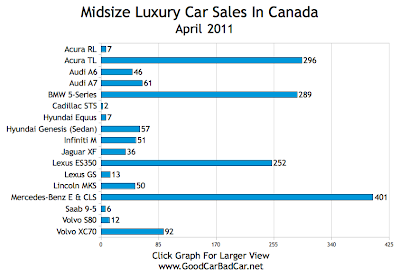

Hyundai Equus: U.S. sales are 35.2 times stronger.

Land Rover Range Rover: U.S. sales are 26.9 times stronger.

Mini Countryman: U.S. sales are 15.6 times stronger.

Toyota Avalon: U.S. sales are 66.4 times stronger.

Dodge Grand Caravan: only 1.9 times better in the U.S.

Fiat 500: pretty much on par in North America; 67 units stronger in the States.

Ford F-Series: just 5.9 times better in the U.S.

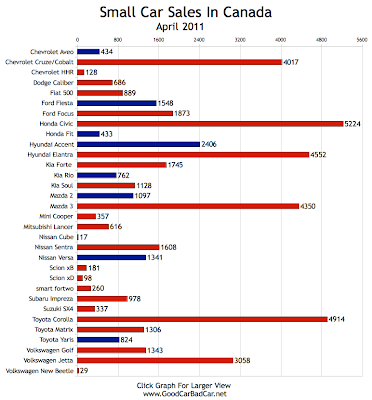

Hyundai Accent: just 2.8 times better in the U.S.

Mazda Tribute: 1.2 times stronger in Canada.

Mitsubishi Outlander: only 1.6 times better in the U.S.

Toyota Venza: just 2.6 times better in the U.S.

*All figures relate to year-to-date figures through the end of April 2011

Related From GoodCarBadCar.net

Top 20 Best-Selling Cars In America - April 2011

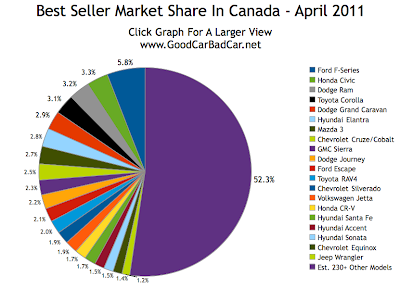

Top 20 Best-Selling Cars In Canada - April 2011

U.S. Auto Sales By Brand - April 2011

Canada Auto Sales By Brand - April 2011

Three pertinent points must be made before we bother looking at specific automobiles. First, there are specific models available in the U.S. which aren't available in Canada, and vice versa. Second, there's a huge set of financial factors at play, from fuel prices to currency exchange and unique tariffs. Finally, Canadians buy more vehicles on a per capita basis. Through the first four months of 2011, there was one vehicle sold for every 70 people in Canada. During the same period, Americans acquired one vehicle for every 73 people. In other words, despite a population that's nine times bigger than Canada's, America's new vehicle market so far this year is only 8.5 times bigger.

With all that explained, here's a quick look at a few vehicles Americans buy with exceedingly greater frequency than their friendly neighbours to the north, along with some others that Canadians are more likely to acquire. Keep two aforementioned figures in mind: nine and 8.5, the numbers by which you'd multiply Canada's population and new vehicle market size to arrive at the American totals.

Chevrolet HHR: U.S. sales are 58.6 times stronger.

Ford Explorer: U.S. sales are 16.2 times stronger.

Honda CR-Z: U.S. sales are 21.7 times stronger.

Hyundai Equus: U.S. sales are 35.2 times stronger.

Land Rover Range Rover: U.S. sales are 26.9 times stronger.

Mini Countryman: U.S. sales are 15.6 times stronger.

Toyota Avalon: U.S. sales are 66.4 times stronger.

Dodge Grand Caravan: only 1.9 times better in the U.S.

Fiat 500: pretty much on par in North America; 67 units stronger in the States.

Ford F-Series: just 5.9 times better in the U.S.

Hyundai Accent: just 2.8 times better in the U.S.

Mazda Tribute: 1.2 times stronger in Canada.

Mitsubishi Outlander: only 1.6 times better in the U.S.

Toyota Venza: just 2.6 times better in the U.S.

*All figures relate to year-to-date figures through the end of April 2011

Related From GoodCarBadCar.net

Top 20 Best-Selling Cars In America - April 2011

Top 20 Best-Selling Cars In Canada - April 2011

U.S. Auto Sales By Brand - April 2011

Canada Auto Sales By Brand - April 2011